Did Donald Trump sign a bill to launch the Epstein documents? Complete Breakdown & facts

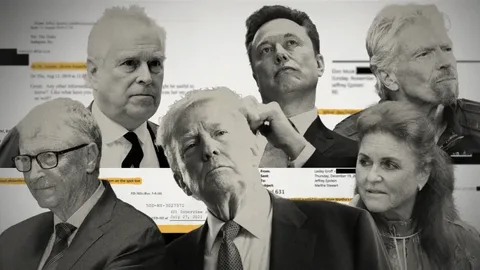

One of the most chronic questions circulating online these days is whether former President Donald Trump signed a bill to release the Epstein documents. The idea has sparked severe interest across social media, search engines, and information forums—frequently mixing established statements with public speculation. Supporters of this declare argue that political pressure caused the formal authorization of record releases. Critics contend that the question is rooted in a false impression of how prison unsealing techniques work in US courts. So what’s the reality? Did Donald Trump signal a bill to release the Epstein files, or is this a fable fueled by misinformation and conspiracy theories? In this article, we can explore the real timeline, criminal mechanisms for public document access, and why this question became trending within the first region. Donald Trump’s Connection to the Epstein Case: An Outline Earlier than answering whether or not Donald Trump signed a bill to launch the Epstein files, it facilitates to apprehend Trump’s ancient connection to Jeffrey Epstein. In the nineteen nineties and early 2000s, Trump and Epstein were socially familiar—both rubbing elbows in elite circles in Palm Beach and NY. Trump made public remarks beyond that that have been impartial or maybe complimentary towards Epstein but later distanced himself after Epstein’s felony problems received public interest. Regardless of this non-public overlap, there may be no confirmed proof that Trump became directly worried within the legal decisions surrounding the release of Epstein’s court files. The affiliation between Trump and the Epstein case in large part pertains to social proximity, not felony authority over federal or private litigation statistics. Prison Mechanisms for Releasing the Epstein Files To determine whether any president, such as Trump, could sign an order to release the Epstein files, we want to recognize how legal unsealing works within the U.S. Judicial orders, no longer government movement, generally govern the release of court records and sealed documents. Most of the Epstein files emerged via civil litigation, court docket orders, and public facts requests—not via government regulation. Inside the U.S., files filed in a federal court docket are technically public until sealed by a judge. Lawyers for victims and civil litigants can request that records be unsealed, and judges evaluate these requests based on legal standards, including public interest, privacy concerns, and evidentiary fees. Presidents no longer have direct authority to order the unsealing of judicial statistics, surely by means of signing a bill. A president may want to theoretically help rules that adjust how sealed documents are dealt with at a systemic level; no such regulation specifically concentrated on Epstein-associated data was signed by Trump during his time in office. Timeline of Epstein File Availability The discharge of Epstein-associated files occurred via the following felony and procedural steps: In the mid-2000s, Epstein was first investigated in Florida, resulting in a plea deal that drew public grievance for its leniency. Civil lawsuits followed within the 2010s, with legal professionals for sufferers submitting motions and asking for the right of entry to records that were sealed. In 2019, after Epstein’s arrest and the next loss of life in custody, public strain intensified for transparency in court docket lawsuits and files. Through the years, judges in numerous jurisdictions unsealed sure files, specifically whilst news reporting or civil litigation demanded transparency. Journalists and felony advocates also filed Freedom of Records Act (FOIA) requests for precise records, contributing to piecemeal public access. Importantly, none of these steps concerned Trump signing a bill to launch the documents. As an alternative, the machine opened up through judicial selections, criminal motions, and media stress. Why the Question Circulates Online The perception that “Donald Trump signed an invoice to launch the Epstein files” has become a trending search question for a mixture of reasons. First, the Epstein case intersects with politics, excessive finance, and elite networks—making it a frequent issue of speculation. Second, misinformation and social media amplification frequently blur strains among tested events and informal conjecture. During and after Trump’s presidency, conspiracy narratives involving elite actors and secret documents were observed by a target audience in numerous online communities. Claims that Trump used government electricity to liberate ‘hidden’ documents fit this narrative style, even though no verifiable legislative act helps to declare. Public interest also surged when information outlets reported on newly unsealed documents. In online discussions, a few misattributed the discharge to executive movement instead of the information on the prison unsealing technique. The confusion persists due to the fact that judicial releases frequently appear to show up all at once, leading uninformed audiences to deduce political influence. Public speculation and Misinterpretation Public speculation about Trump’s involvement frequently stems from broader narratives about electricity, secrecy, and elite duty. A few have argued that high-degree influence becomes vital to “freeing up” powerful figures mentioned inside the documents. Others claim that presidents can declassify files unilaterally and therefore may also force the launch of judicial facts. Those theories forget about key prison distinctions. Declassification powers apply to classified national protection documents held through the government branch, not to civil litigation information held by means of courts. Courts function independently of the government branch, and judges decide what to seal or unseal based on legal requirements, no longer presidential preference. Capitol Hill legislation, despite the fact that it was surpassed, commonly calls for both clear jurisdictional authority and amendments to existing federal tactics, and none of this passed off inside the context of Epstein file releases. Latest Updates on Epstein Files (2025 Context) As of 2025, the Epstein files remain to emerge through legal transparency measures, now not via government movement. Civil courts in the Big Apple and Florida have unsealed extra motions and deposition transcripts, while journalists keep pursuing FOIA requests for supplementary government records. Media coverage often highlights newly available files with headlines that imply huge prison exposure, but it’s vital to separate criminal release mechanisms from political involvement. Judges and appellate courts continue to be the number one government over what turns into public. Mainstream outlets have

Did Donald Trump sign a bill to launch the Epstein documents? Complete Breakdown & facts Read More »